mass wage tax calculator

Compare your take home after tax and estimate your tax return online great for single filers married filing jointly head of household and widower. Enter your filing status income deductions and credits and we will estimate your total taxes.

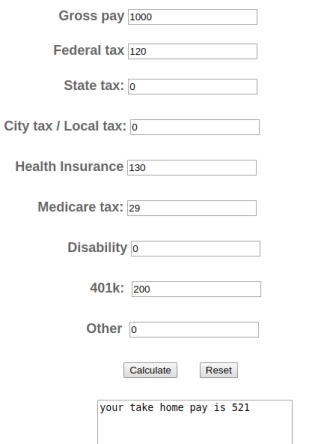

Paycheck Calculator Take Home Pay Calculator

Ad Free For Simple Tax Returns Only With TurboTax Free Edition.

. The calculator will automatically assume that the employer takes the maximum possible tip credit and calculate tip and cash wage earnings accordingly. Switch to Massachusetts hourly calculator. Learn about contribution rates and use the calculator to estimate your contribution.

This breakdown will include how much income tax you are paying state taxes federal taxes and many other costs. Your average tax rate is 222 and your marginal tax rate is 361This marginal tax rate means that your immediate additional income will be taxed at this rate. Take home pay is calculated based on up to six different hourly pay rates that you enter along with the pertinent federal state and local W4 information.

There are five states that do not. Based on your projected tax withholding for the year we can also estimate your tax refund or amount you may owe the IRS next April. Massachusetts has a flat tax of 513 on most types of income.

Self-employed individuals on the other hand have to calculate and pay these taxes themselves. The Massachusetts Salary Calculator is a good calculator for calculating your total salary deductions each year this includes Federal Income Tax Rates and Thresholds in 2022 and Massachusetts State Income Tax Rates and Thresholds in 2022. For example if an employee earns 1500 per week the individuals annual income would be 1500 x 52 78000.

Massachusetts is a flat tax state that charges a tax rate of 500. If you make 130000 a year living in the region of Massachusetts USA you will be taxed 28489. The combined tax rate is 153.

Massachusetts Income Tax Calculator 2021. That goes for both earned income wages salary commissions and unearned income interest and dividends. Check if you have multiple jobs.

Created with Highcharts 607. As an employer you must withhold Massachusetts personal income taxes from all Massachusetts residents wages for services performed either in or outside Massachusetts and from nonresidents wages for services performed in Massachusetts. Property Tax 4123.

How to calculate annual income. It is not a substitute for the advice of an accountant or other tax professional. Number of Qualifying Children under Age 17.

Seven states have a flat income tax and of those seven Massachusetts has the highest state income tax rate. The law states that whichever is the higher applies to employers in that state. The Paycheck Calculator may not account for every tax or fee that applies to you or your employer at any.

The calculator will show you the total sales tax amount as well as the county city and special district tax rates in the selected location. While the tax rate is set explicitly by the Massachusetts legislature the Massachusetts personal exemption is indexed to inflation and changes every year. The federal minimum wage is 725 per hour and the Massachusetts state minimum wage is 1425 per hour.

The information provided by the Paycheck Calculator provides general information regarding the calculation of taxes on wages for Massachusetts residents only. To use our Massachusetts Salary Tax Calculator all you have to do is enter the necessary details and click on the Calculate button. See where that hard-earned money goes - Federal Income Tax Social Security and other deductions.

Get Rid Of The Guesswork And Have Confidence Filing With Americas Leader In Taxes. Choose Marital Status Single or Dual Income Married Married one income Head of Household. Normally the 153 rate is split half-and-half between employers and.

As a 1099 earner youll have to deal with self-employment tax which is basically just how you pay FICA taxes. Massachusetts is one of the states that has a minimum wage rule and ensures that their employers pay it. Massachusetts allows employers to credit up to 765 in earned tips against an employees wages per hour which can result in a cash wage as low as 435 per hour.

Massachusetts has a 625 statewide sales tax rate and does not allow local. Calculate your Massachusetts net pay or take home pay by entering your per-period or annual salary along with the pertinent federal state and local W4 information into this free Massachusetts paycheck calculator. Number of Allowances State W4 Pre-tax Deductions 401k IRA etc Check Date MMDDYYYY.

Details of the personal income tax rates used in the 2022 Massachusetts State Calculator are published. Percent of income to taxes 32. More information about the calculations performed.

The Hourly Wage Tax Calculator uses tax information from the tax year 2022 to show you take-home pay. Paying taxes as a 1099 worker. New employers pay 242 and new construction employers pay 737 for 2022.

On the first 15000 each employee earns Massachusetts employers also pay unemployment insurance of between 094 and 1437. Get Your Max Refund Today. This Massachusetts hourly paycheck calculator is perfect for those who are paid on an hourly basis.

You can use our Massachusetts Sales Tax Calculator to look up sales tax rates in Massachusetts by address zip code. Employers also have to pay a Work Force Training Contribution of 0056 and a Health Insurance Contribution of 5. Overview of Massachusetts Taxes.

How much do you make after taxes in Massachusetts. If you make 55000 a year living in the region of New York USA you will be taxed 12213That means that your net pay will be 42787 per year or 3566 per month. Total Estimated Tax Burden 17820.

After a few seconds you will be provided with a full breakdown of the tax you are paying. Massachusetts Salary Paycheck Calculator. Your household income location filing status and number of personal exemptions.

Massachusetts Hourly Paycheck Calculator. Most Massachusetts employers must make payroll withholdings on behalf of their workforce to comply with the Paid Family and Medical Leave law. The state-level payroll tax is 075 of taxable wage up to 137700 and the income tax is a flat rate of 5.

Our income tax calculator calculates your federal state and local taxes based on several key inputs. To calculate an annual salary multiply the gross pay before tax deductions by the number of pay periods per year. A single filer will take home 5762050 on a 78000 annual wage.

2021 Massachusetts Tax Tables with 2022 Federal income tax rates medicare rate FICA and supporting tax and withholdings calculator. Withholding refers to income tax withheld from wages by employers to pay employees personal income taxes.

Download Excel Based Income Tax Calculator For Fy 2020 21 Ay 2021 22 Financial Control Income Tax Income Tax

Free Online Paycheck Calculator Calculate Take Home Pay 2022

Welcome To Tibari 101 Financial We Are Up To Date With Any New Laws To Better Serve You When Filing Your Tax Prepar Tax Prep Tax Preparation Income Tax Return

.jpg)

Income Tax Calculator Estimate Your Refund In Seconds For Free

Fha Changes May Tighten Credit For Homebuyers Realestateagent Firsttimehomebuyer Massachusetts Massachusetts Association Of Buyer Agents Investing Financial Management Financial

How To Calculate Income Tax In Excel

How Much Should I Set Aside For Taxes 1099

Massachusetts Income Tax Calculator Smartasset Com Income Tax Income Tax

Quarterly Tax Calculator Calculate Estimated Taxes

In Case You Missed It Today Is Tax Day For The Us That Means You Need To Get Your Taxes Submitted Stamped Or An Extension File Tax Day You Got This

Massachusetts Paycheck Calculator Smartasset

Open Tax Solver V18 00 Easy To Use Program For Calculating Tax Return Forms Opensource Taxes Taxseason Tax Software Tax Return Tax Time

Massachusetts Paycheck Calculator Smartasset

Paycheck Calculator Take Home Pay Calculator

Salary Calculator Salary Calculator Salary Calculator Design

Payroll Tax What It Is How To Calculate It Bench Accounting

Tax Services Boston Ma Tax Preparer Near Me Tax Pro America Filing Taxes Income Tax Tax Refund

E File Itr Itr Amp Tax Filing Online Very Simpale With Allindiaitr How To Filing Itr Income Tax Return 31st Mar Income Tax Return Tax Return Income Tax